CPAs may specialize in different practice areas, such as tax, auditing, personal finance planning, or business valuation services. Even if an accountant has a degree and a certification, it doesn’t mean they are a better choice than a bookkeeper with sufficient experience. How much you make as a first-year accountant depends mainly on the specific career path you pursue. While accounting can be a lucrative long-term career, most accountants, unlike corporate attorneys or investment bankers, do not command huge salaries during the first few years. A bookkeeper usually performs these steps, however, an accountant may step in to complete these tasks, or oversee them as they’re completed by the bookkeeper. The accounting process is more subjective than bookkeeping, which is largely transactional.

Regardless of the type of bookkeeping a company chooses, recording the day-to-day business financial transactions is an integral part of accounting. These days, most popular accounting software programs do both bookkeeping (transaction recording) and accounting (preparing financial reports, analyzing trends, etc.). Typically, bookkeepers aren’t required to have any formal credentials or licenses. To be successful in their work, bookkeepers need to be sticklers for accuracy, and knowledgeable about key financial topics.

All-in-one money management

The BLS notes that job growth for accountants should track fairly closely with the broader economy. However, bookkeepers will face pressure from automation and technology that will reduce the demand for such workers. As discussed above, the main objectives of accounting and bookkeeping are similar but still different in many ways.

Bookkeepers who are interested in switching jobs but do not have a college degree might consider becoming an EA after a stint with the IRS. This job doesn’t require a college degree, only five years of tax experience with the IRS. If you are already a CPA, you can act as an enrolled agent without passing the exam. Bookkeepers may start working for a small business to gain experience and then go back to school bookkeeping vs accounting for a degree in accounting or finance. Enrolling in one of the best online bookkeeping classes is a smart way for those interested in this career to bolster their existing financial knowledge. As an accountant, you may work for a company or yourself, and there are opportunities for accountants in many industries like law, insurance and health, small business, and, of course, tax accounting firms.

Advantages of working with a bookkeeper

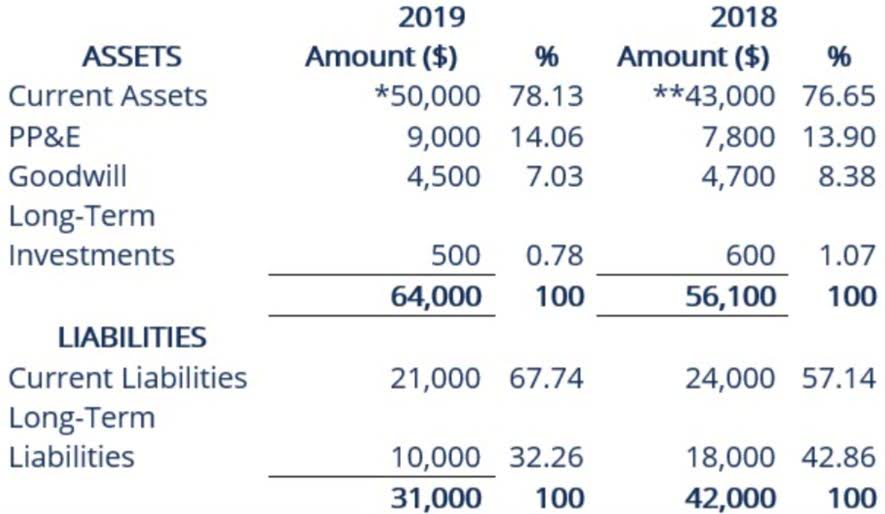

To qualify for the title of an accountant, generally an individual must have a bachelor’s degree in accounting. For those that don’t have a specific degree in accounting, finance degrees are often considered an adequate substitute. Goodwill is a very complicated concept that typically applies in acquisitions. It accounts for a purchase price that is higher than the fair net value plus the company’s assets put together. Essentially, it accounts for brand value, market share, customer base, and all other intangible assets that may make a company attractive to a potential purchaser.

Many small business owners attempt to save money by performing the recordkeeping duties of a bookkeeper themselves with the help of automated software, such as Intuit or Quickbooks. This can help save money and keep a small business lean, although it requires a major time commitment and meticulous attention to detail from the business owner. While it is important for every type of business owner to understand the financial side of their business, bookkeepers and accountants can make that process far less labor intensive for the business owner. When it comes to deciding between one or the other, think of them as a pair working in tandem. As you can imagine, there are quite a few differences between bookkeepers and accountants, including the level of education each job requires. Many business owners decide to hire bookkeeping or accounting help when their business finances have become more complicated to manage alone.

Which Accounting Jobs Are in Demand?

Instead, an accounting firm may hire an in-house bookkeeping team or partner with their client’s bookkeeper to provide business owners with the expertise and financial support they need. Bookkeepers sometimes do accounting tasks, such as generating financial reports from the accounting software, making journal entries for depreciation and accrued expenses, and more. As an accountant, you must pay attention to figures and financial details, but it is more essential to possess sharp logic skills and big-picture problem-solving abilities.

- As your business grows, it’s important to invest in professionals who can keep your accounting system on track, free up your time, and help you make better decisions for your business.

- Enter the payment amount to calculate Stripe’s transaction fees and what you should charge to receive the full amount.

- This is the equivalent of around $45,000 per year, assuming a 40-hour workweek.

- An accountant uses the financial data provided by a bookkeeper to interpret, analyze, and report on the financial health of the business.

- Bookkeepers are commonly responsible for recording journal entries and conducting bank reconciliations.

- Take your business to new heights with faster cash flow and clear financial insights —all with a free Novo account.

As an accountant, you may have to crunch numbers, but those are not the only skills needed. It is important to possess sharp logic skills and big-picture problem-solving abilities, as well. While bookkeepers make sure the small pieces fit properly into place, accountants use those small pieces to draw much more significant and broader conclusions. Taking the next step in maintaining your company’s records can seem daunting, but there are plenty of options available that will make it easier for you to stay focused on growing your business.

What is goodwill in accounting?

You may not mind balancing the books and handling financial transactions, and software like QuickBooks Online, FreshBooks and Xero can automate a significant amount of this work. But as your business expands, bringing on a bookkeeper can alleviate your workload and free up your time to devote to other areas of the business. There are significant differences when it comes to bookkeeping and accounting, and it’s important to know whom to turn to for what tasks. Bookkeepers can help organize your day-to-day finances, such as your daily sales, expenses, and even payroll.

- A bookkeeper must catch tiny or hidden mistakes because even small ones can affect your business.

- This can help save money and keep a small business lean, although it requires a major time commitment and meticulous attention to detail from the business owner.

- Small business accounting software like QuickBooks helps you track your business finances all in one place, making it easily accessible to you and your accounting team.

- While it can be reassuring to see letters after an individual’s name, we recommend focusing instead on finding an accountant who offers the services you need, you feel comfortable with, and trust.

- Accountants, unlike bookkeepers, are also eligible to acquire additional professional certifications.

- Accounting is not only the systematic recording of financial data but also the analysis, interpretation, and presentation of this data.